Saving For Retirement

How much should you save for retirement? There’s not a simple answer as everyone’s circumstances are different but I’ll offer a framework to think about this question.

To begin, consider these 4 questions:

- What will your living expenses be during retirement?

- What income — i.e., part-time work, Social Security, pension, annuity — do you expect during retirement?

- What is your life expectancy?

- Do you have dependents or heirs to consider?

1. What will your living expenses be in retirement?

A simple approach is to assume your living expenses won’t change too much when you retire. Yes, commuting and clothing expenses will go down, but spending on grandchildren and health care will go up, so they may roughly cancel out.

Let’s also assume you spend all your income except for 15% that you’re contributing to your retirement account and that another ~8% of your paycheck goes to FICA payroll taxes. That leaves 77% of your gross income being spent on your living expenses and income taxes. If you’re saving more or less than 15%, adjust for that.

You may be wondering about future income taxes. If you’re saving in a pre-tax retirement account, you’ll pay income tax on the future distributions, perhaps at a slightly lower average tax rate. If you’re saving in a Roth retirement account, you won’t pay tax on these future distributions and thus you won’t be spending quite as high a percentage in retirement.

Let’s use 75% of your gross income as your living expenses as a rough approximation. For most people, Social Security will replace less than half of that amount so you’ll need to come up with the rest from your savings.

2. What income do you expect in retirement?

If you’re not receiving a pension or continuing to work part-time, the only income you can expect in retirement is Social Security. Don’t count distributions from your retirement accounts as income for this purpose. That’s your savings you’ll be using for living expenses and it’s that amount we want to calculate.

How much will Social Security provide? It depends on your:

- work history — the more you work, the more you get

- claiming age — the longer you delay, the more you get

- income level — the higher your income, the less you get (as a percentage of your income)

Here’s a rough rule of thumb — for a someone who worked a full career and averaged $80,000 (in today’s dollars) and begins collecting at age 67, you can expect to receive ~33% of your pre-retirement income in Social Security benefits.

That means you need to cover another 42% of your prior income from your savings to get you to living expenses that equal 75% of your pre-retirement income.

3. What is your life expectancy?

In the US, the average life expectancy of a 65 year old woman is another 21 years. Of course, that’s the average so if your health is good, plan to live into your 90s. There’s a good chance you’ll make it.

Obviously, a long life expectancy means you need a bigger retirement nest egg.

4. Do you have heirs to consider?

Would you like to leave something behind or would your goal be to spend your last nickel on the eve of your exit from this earth? If you do want to leave something behind, then again, you’ll need to save more to have that cushion.

OK, how much to save?

Once you’ve considered those 4 questions, I can give you an estimate of your retirement savings requirements in two different ways:

- How much should you save each paycheck?

- Are you on track?

1. How much should you save each paycheck?

The future is uncertain and your savings rate depends on the factors mentioned above so the answer is imprecise. With that caveat and assuming you work and save continually throughout your working lifetime, here’s about how much you should save based on the age at which you begin:

| Starting Age | Target Savings Rate |

| twenties | 15 – 20% |

| thirties | 20 – 25% |

| forties | 25+% |

Note that these savings rates include any employer match. And, if you have a pension, you can save less.

If you wait until your forties to begin saving, your retirement goals become more challenging, but are still achievable. You’ll need to reduce your current spending and you may need to work more years before beginning retirement.

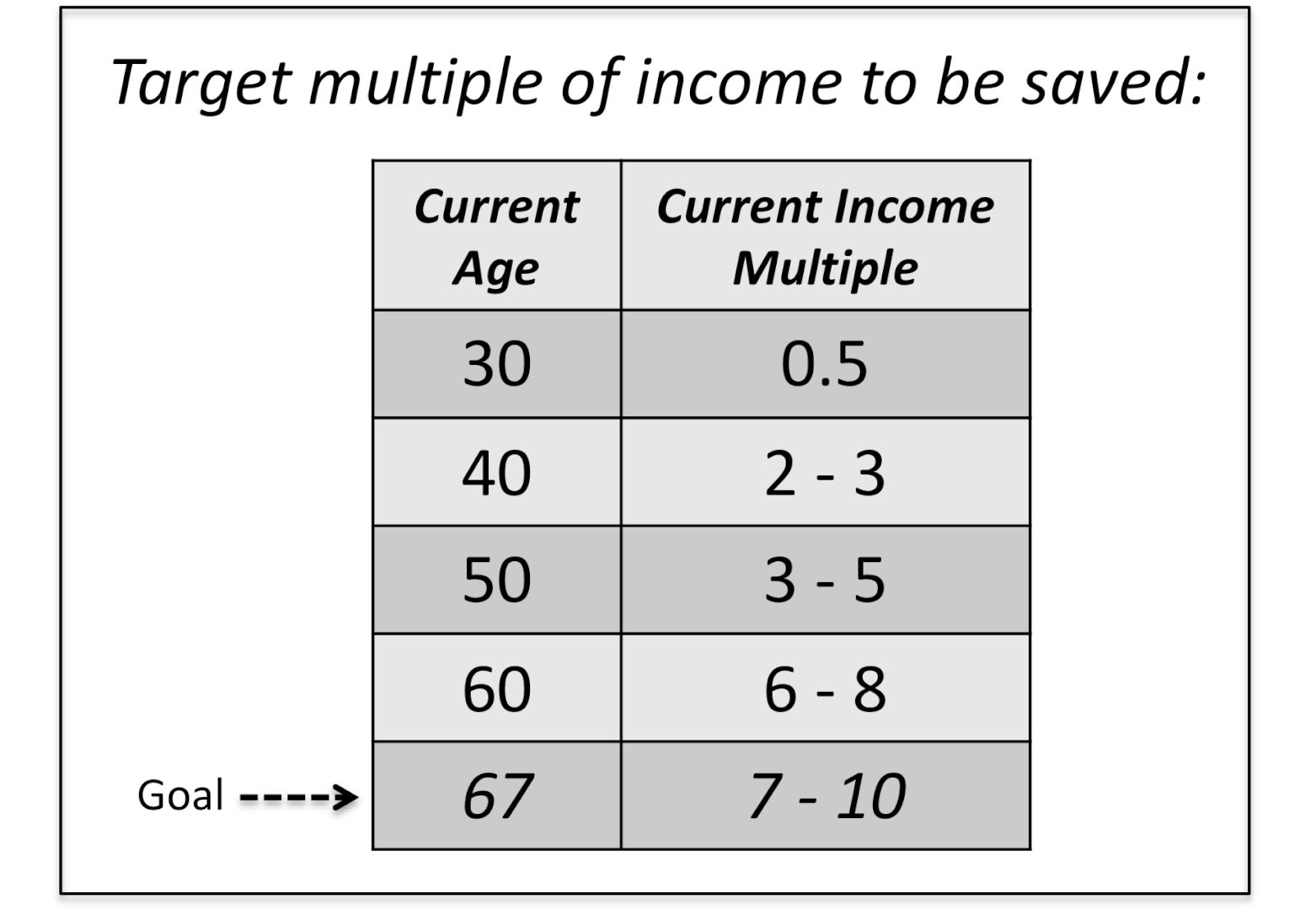

2. Are you on track with your retirement savings?

This table answers that question:

To orient you around this table:

- If you’re 30 and your income is $40,000, you should have $20,000 saved to be on track.

- If you’re 40 and your income is $60,000, your target is between $120,000 and $180,000 in retirement savings.

- If you’re 67 and retiring with a previous income of $80,000, you should have between $560,000 and $800,000 saved to maintain your pre-retirement standard of living.

Lastly, what if you’re behind on your savings goal?

Anytime is a good time to begin to catch up. The longer you put it off, the steeper the hill you’ll have to climb.

If you’re behind and want to maintain your standard of living in retirement, you’ll need to do a combination of spending less (so you can save more) and working more years. Those two changes have big positive effects on your retirement security and can get you back on track. By doing so, you will:

- reduce your current and future living expenses

- have more years to save

- delay when you claim Social Security and thus receive a larger benefit

- have fewer years in retirement to support yourself

A good next step is to check your 401K contributions and see if you’re on track in terms of both the percentage you contribute and your current savings balance.

Do you need help planning for your retirement? Get in touch to learn about my Retirement Readiness service.