Don’t just do something, sit there

Given the state of the world and the associated stock market volatility, it’s understandable to wonder if now is a good time to panic. There’s no good answer — I don’t know what’s ahead for either the war in Ukraine, the direction of the stock market, or whether inflation will spiral up. However, no one else does either.

Well, that’s not very helpful. So what should one do in times like these?

I wrote a variation of this note two years ago in the midst of the coronavirus stock market rout. This seems like a good time for an update reflecting our present circumstances. My answers are the same:

- Maintain perspective.

- Focus on what you can control.

- Tune out what you can’t.

First, maintain perspective.

Since the stock market high around the end of December 2021, the stock market is down ~13%. That’s not so bad, considering a war is raging in Europe and inflation has re-emerged throughout the world.

Stock market returns since 2000 have been strong. In spite of the current Russian invasion and inflation spike, the Coronavirus Scare of 2020, the financial meltdown in 2008, and the dot com crash of 2001 and 2002, annualized stock returns have averaged nearly 11% in this century-to-date. That’s pretty good.

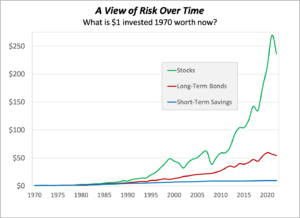

And, here’s a longer time period, dating back to 1970. I like to use a 50-year horizon because it roughly corresponds to the lifetime of a typical investor.

Three things should be clear:

- Stocks have been a good investment, although quite a roller coaster ride.

- Bonds have been a safer investment (i.e., smaller swings) but the returns are much lower over the long run.

- Cash is even safer (i.e., no downward swings) but has been a terrible long-term wealth accumulation strategy. After accounting for inflation, it’s a loss.

Second, focus on what you can control.

- Optimize your asset allocation (the mix of different asset classes) for your age, risk tolerance, and financial situation. Occasionally, rebalance as circumstances change.

- Ensure your investments are well-diversified, including non-US stocks.

- Minimize your investment expenses such as fees from mutual funds, variable annuities, and financial advisors.

- Minimize your investment taxes by using tax-sheltered savings such as retirement, health savings, and college savings accounts.

- Evaluate re-financing your mortgage or other consumer debts — or pay them off, if you can afford to do so.

- Maintain a long-time horizon. Maybe this time will be different, but one lesson from past stock market declines has been that the market will rebound.

Third, tune out what you can’t control.

It’s a fool’s errand to try and outsmart the day-to-day volatility of investment markets. People and markets can be fickle, irrational, and vacillate between fear and greed. There’s little you can do to fight those collective emotions. Try doing nothing.

If you want to time the market, good luck. You have to be right twice — once when you decide to sell and again when you decide to re-enter. That’s awfully hard to do.

These stock market routs occur regularly and there’s no reason to think they won’t continue in the future. Don’t check your account balances, unless you have a specific need to do so. You may over-react and make a move that you’ll later regret.

Sometimes, the best strategy is the meditative one:

Don’t just do something, sit there.

Easy to say, hard to do. Try to ride out the latest storm and instead direct your emotional energy to supporting the besieged Ukrainians.